REVACY

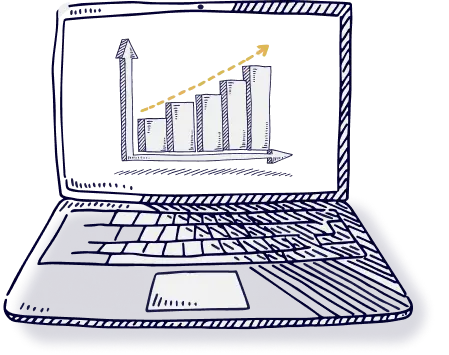

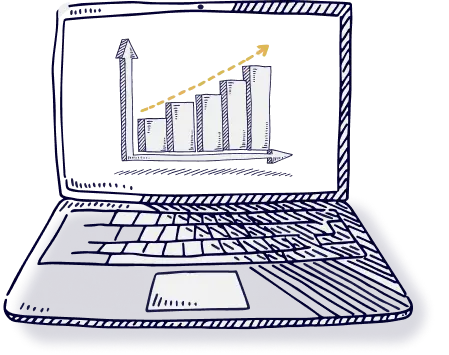

At The Revacy Fund, we blend advanced trading technology with the timeless investment approach of holding and compounding to nurture exponential growth over time.

We have created a finely-tuned hybrid approach that combines the benefits of trading and investing, perfect for systematic trend-following.

Our strategy is rooted in a 100% data-driven, systematic method, ensuring decisions are made objectively and free from emotional biases.

We continuously scan and rotate through sectors to capture the best-performing stocks from the strongest sectors.

Our methodical approach seamlessly aligns with medium to long-term market trends, typically 12 to 18 months, providing timely insights into shifts from bullish to bearish trends.

While focusing primarily on the dynamic US and UK stock markets, we also embrace opportunities in forex and commodities when clear trends are identified.

Our goal is to grow your investments steadily and securely, staying true to our commitment to smart, disciplined investing.

Founder & CEO

Founder & CIO

The Revacy Fund is a shared vision of the co-founders, Zaheer Anwari and Kola Gbadamasi, uniting their extensive experience in investing and trend-following, a strategy recognised for its performance.

Disillusioned with traditional approaches and driven by a deep commitment to learning and innovation, they've built a credible presence online and in the investment community.

Featured in top industry publications like MoneyShow, Investing.com, and Benzinga, their journey reflects resilience and a genuine commitment to financial education.

The success of their trend-following approach is backed by a track record and the achievements of those they've mentored.

Transitioning from mentors to fund managers, Zaheer and Kola established The Revacy Fund in partnership with DHF Asset Management in 2023.

Their mission is clear: to provide exceptional returns for their investors and forge a new path in fund management.

We’ve created a unique scanning and analysis method that blends advanced technology with technical analysis to consistently identify and invest in top-performing stocks within strong sectors. Our technology efficiently evaluates thousands of stocks, carefully selecting only the best assets for the portfolio. The process is not entirely automated. Human judgment and our expert eye play a crucial role in choosing the final assets for the portfolio.

Our values are rooted in over 30 years of combined investing experience. We’ve built our approach on time-tested investing principles and a rigorous adherence to risk management. At the heart of Revacy Ltd. lies a commitment to capital preservation and achieving consistent returns over medium to long-term horizons. We believe in a balanced approach that respects both the volatility and opportunities presented by the markets.

We adhere to time-tested trend-following principles: “the trend is your friend until the bend at the end” and “cut your losers short, let your winners run.” Our meticulous risk and exit strategy mitigates losses by swiftly exiting losing positions. Our approach seeks to optimise potential returns through strategic reinvestment in proven stocks following market trends. See risk disclosure

At The Revacy Fund, we prioritise clear communication with our investors. Whether you have questions, feedback or need personalised help, we’re here for you. Reach out using the form below, and our team will respond promptly.